Note: A version of this post also made an appearance at OpenFile Toronto.

Some notes on the budget that continues to barrel toward us like a… — I’d say train, but I feel like we’ve squeezed all the life out of that analogy. In any case, it’s coming for us, this budget, and there is no escape.

(1) The 2012 budget isn’t about austerity

Ex-Ford Chief of Staff Nick Kouvalis took to his Twitter account this week, dropping a bunch of references to the need for austerity in the light of that recent thing where the United States — temporarily, we hope! — tanked the world economy. “Economies, banks are failing — time for austerity” he wrote, presumably sincerely, when asked by poverty activist Ken Wood about library cuts. “Spending must be curbed, reductions made.”

But while there might be an argument to be made for austerity at the provincial and federal levels, that strategy makes almost zero sense at the municipal levels. The other orders of government make their revenue through taxes that are very much dependent on economic conditions — when people lose their jobs, income tax revenues decline; when people stop spending, sales tax revenues decline — but Toronto derives the majority (54%) of its revenue from property taxes and user fees. We’re not in a position where we should cut services for a few years until the economy recovers as our revenues are, for the most part, not linked to overall economic performance.

Any talk that we should cut things like arts funding due to present economic troubles ignores that what we’re talking about here is a structural shortfall requiring structural change. These cuts will be, for all intents and purposes, permanent.

(2) The City’s debt is manageable

Everyone knows Toronto can’t run a deficit on its operating budget, but we do have significant capital debt. Charges related to that debt are the third biggest item on the average property tax bill. Looking beyond the simple fact that the City of Toronto has comparatively far less debt than other governments, however, there remains a critical difference between how the province and the federal government handle things and how we do things on the municipal level. And that difference is this:Â Toronto is actually paying down its debt.

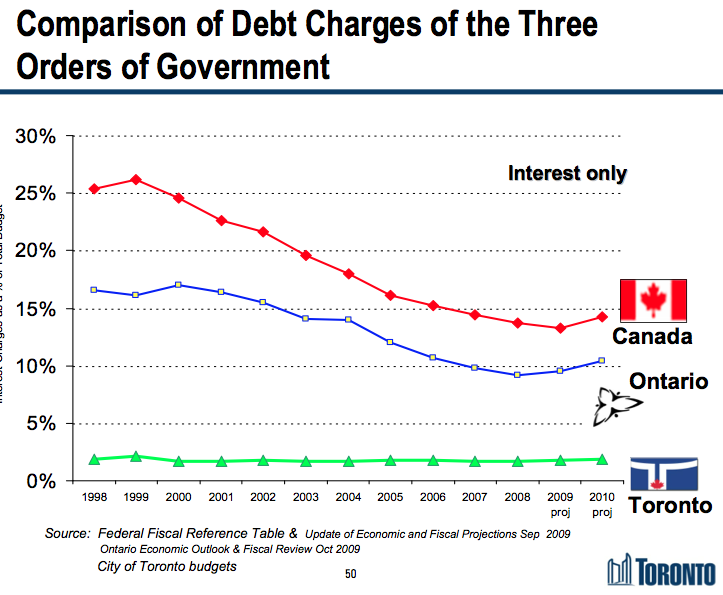

A fun chart comparing debt charges (interest only) as a percentage of overall operating budget. Toronto is the only government actively paying down its debts.Â

That chart (page 50)Â shows the relative health of the city’s indebtedness compared to other governments. It’s also worth noting that the City has some $20 billion in assets

The way the city handles things — we also have our own municipal debt ceiling, of sorts, capped at 15% of operating — is a departure from the expected status quo where governments tend to roll with interest-only payments, especially during times of austerity. Toronto’s problem is not so much the level of existing debt — which is manageable — but rather needed future capital spending projections, primarily relating to the TTC.

This is where a strong commitment from other levels of government is most required. Transit should be a major issue in the provincial election this fall, and Toronto City Council should be leading the charge.

(3) The City has not seen out of control spending

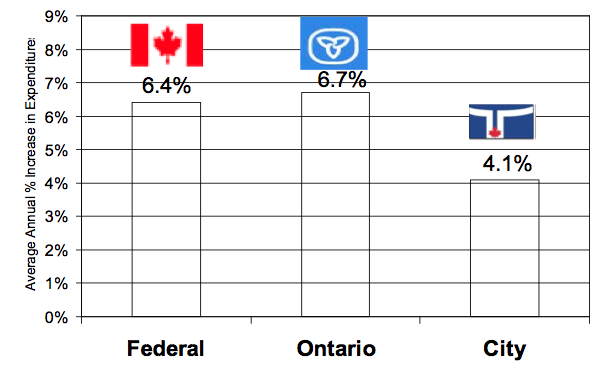

Comparison of spending increases, 1998 to 2010. (Not including debt charges which, as mentioned, the other governments tend not to make principal payments on.)

From 2003 to 2010, the City’s Net Operating Budget — the portion paid for by property taxes — increased from $2.9 billion to $3.6 billion. Or about $100 million per year. The budgetary magic of the David Miller era was pulling in some $500 million in transfers from the provincial government to fund (often provincially-mandated) programs and adding another half-billion in rate-supported programs. But even then, the city’s year-to-year spending increases still fell below the rate-of-growth for other levels of government.

(4) Budget Chief Mike Del Grande has finally come clean about surplus dollars

Councillor Del Grande made a surprise phone-in appearance on Josh Matlow’s new NewsTalk 1010 show on Sunday, and in doing so finally made reference to the fact that there will be significant surplus dollars and other revenues coming out of 2010 that could be applied to the 2011 budget. (These would probably total enough to bring the shortfall down to at the very least last year’s staff estimate of $530 million.)

But here’s the catch: Del Grande wants us to ignore the extra revenues behind the curtain, arguing that the City might need to use those surplus dollars to pay for buy-outs for staff under the program launched this summer. Which, in addition to seeming like a questionable use of funds, could make for a double barrelled shot to the face for residents who rely on city services: not only could they see funding for services reduced, the city is also in danger of prematurely shedding staff who play important and longstanding roles in successful service delivery.

(5) We could have avoided this

One of the first things Speaker Frances Nunziata did when she opened council’s debate on the 2011 budget was rule any mention of the 2012 budget as out of order. An audacious move for an administration that had touted their fiscal prowess and a sincere desire to get the city’s fiscal house in order. Any discussion of long-term planning was, apparently, not allowed.

It’s been noted again and again, but a simple combination of a small property tax increase in last year’s budget and a partial retention of the Vehicle Registration Tax would have resulted in very straightforward budget processes for both 2011 and 2012. This would have allowed the budget committee to focus on a long-term strategy for reducing the city’s annual structural shortfall through a combination of further monetization of city assets, good faith intergovernmental negotiations and some efficiencies — and, yes, potentially cuts — to programs and services.

That’s the part that’s so hard-to-stomach about this whole process. It didn’t have to be this way. But now our city faces an utterly avoidable scenario shaped by a mayor that seemingly harbours a naked ambition to gut services.

Tags: budget, core service review, mike del grande, Nick Kouvalis